Divine Info About What Is The Difference Between COGS And Bill Of Materials

Cost Of Goods Sold Defining & Calculating COGS QuickBooks

Unraveling COGS and Bill of Materials

1. What's the Buzz About COGS and BOM?

Ever found yourself staring blankly at financial reports, wondering what all those acronyms mean? You're not alone! Two terms that often pop up are COGS and Bill of Materials (BOM). While they both play crucial roles in understanding a company's financial health and production process, they represent very different things. Think of them as cousins who attend the same family reunion but lead completely different lives. Ones all about dollars and cents, while the other is a detailed recipe for your product.

Simply put, COGS, or Cost of Goods Sold, is an accounting term. It represents the direct costs associated with producing the goods a company sells. Its a financial snapshot that shows how much it cost to create the products that generated revenue. The Bill of Materials, on the other hand, is a comprehensive list of all the raw materials, components, and sub-assemblies needed to manufacture a single unit of a product. It's like a detailed shopping list for the factory floor. No cranberries missing for thanksgiving holiday!

Imagine youre baking a cake. COGS would be the total cost of all the ingredients (flour, sugar, eggs, etc.), the electricity used to power the oven, and maybe even the bakers hourly wage (if they're directly involved in baking only). The Bill of Materials would be the recipe itself: 2 cups of flour, 1 cup of sugar, 3 eggs, and so on. Clear as mud? Let's dig deeper!

So, you see how they relate but are clearly distinct. COGS gives you the financial impact, while the BOM gives you the ingredients required for the product. Ignoring either of these is like trying to run a business with one eye closed. You might get by, but you wont be as effective as you could be.

Bill Of Material Vs Materials Notebase

COGS

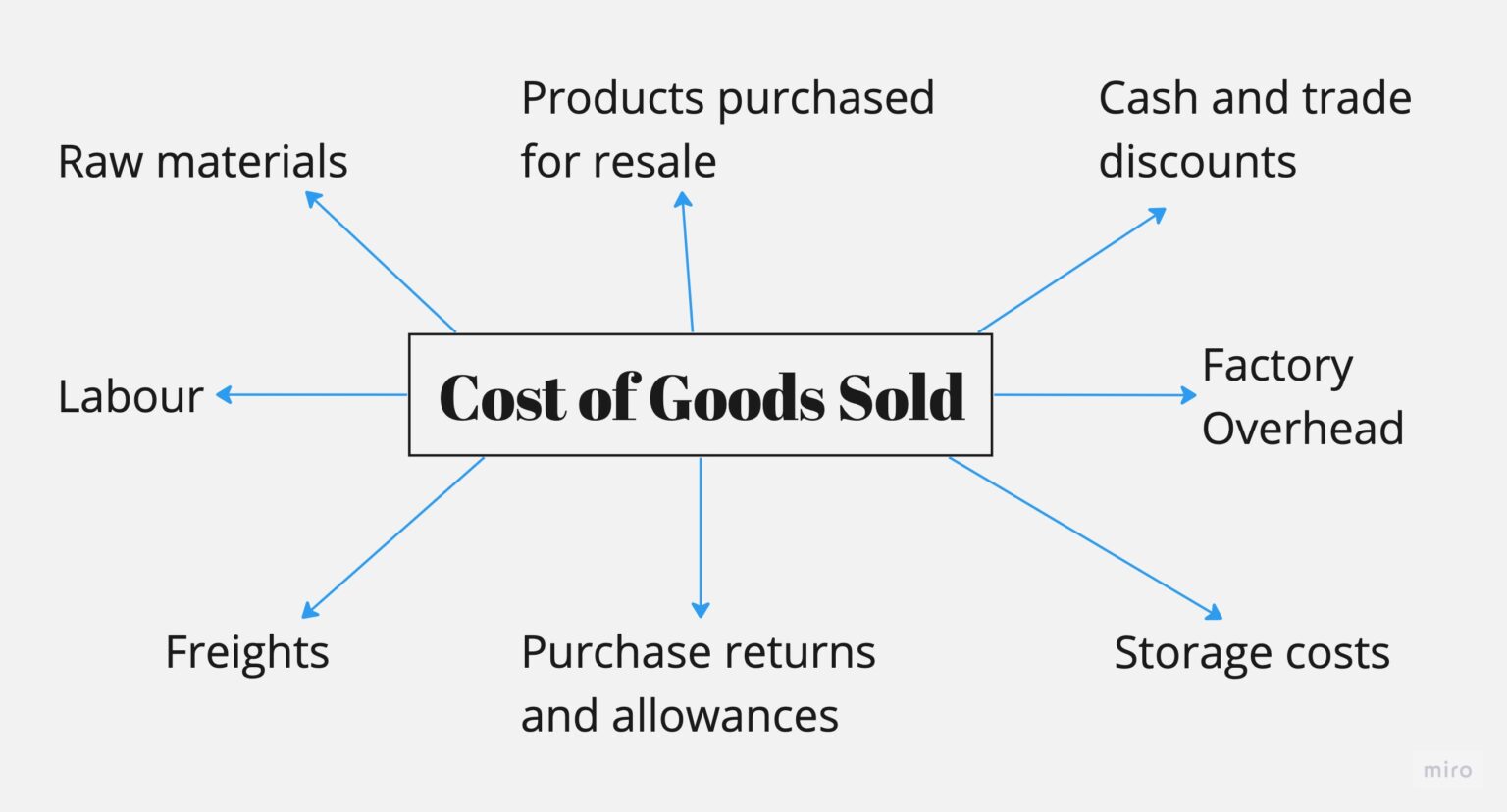

2. Breaking Down the Beast

COGS is a pretty significant number on your income statement because it tells you how much it really cost to create your products. It's not just about the raw materials either. Think about all the costs directly tied to production. This typically includes raw materials, direct labor (the wages of the people who physically make the product), and manufacturing overhead (things like factory rent, utilities, and depreciation of equipment).

Let's revisit our cake example. Your COGS includes the cost of the flour, sugar, eggs, butter, and frosting. It also covers the salary of the baker who mixed it all together (assuming they only bake cakes!), and a portion of the oven's electricity bill and the cost of the kitchen space. Keeping accurate track of these costs is essential for determining the profitability of your products and making informed pricing decisions.

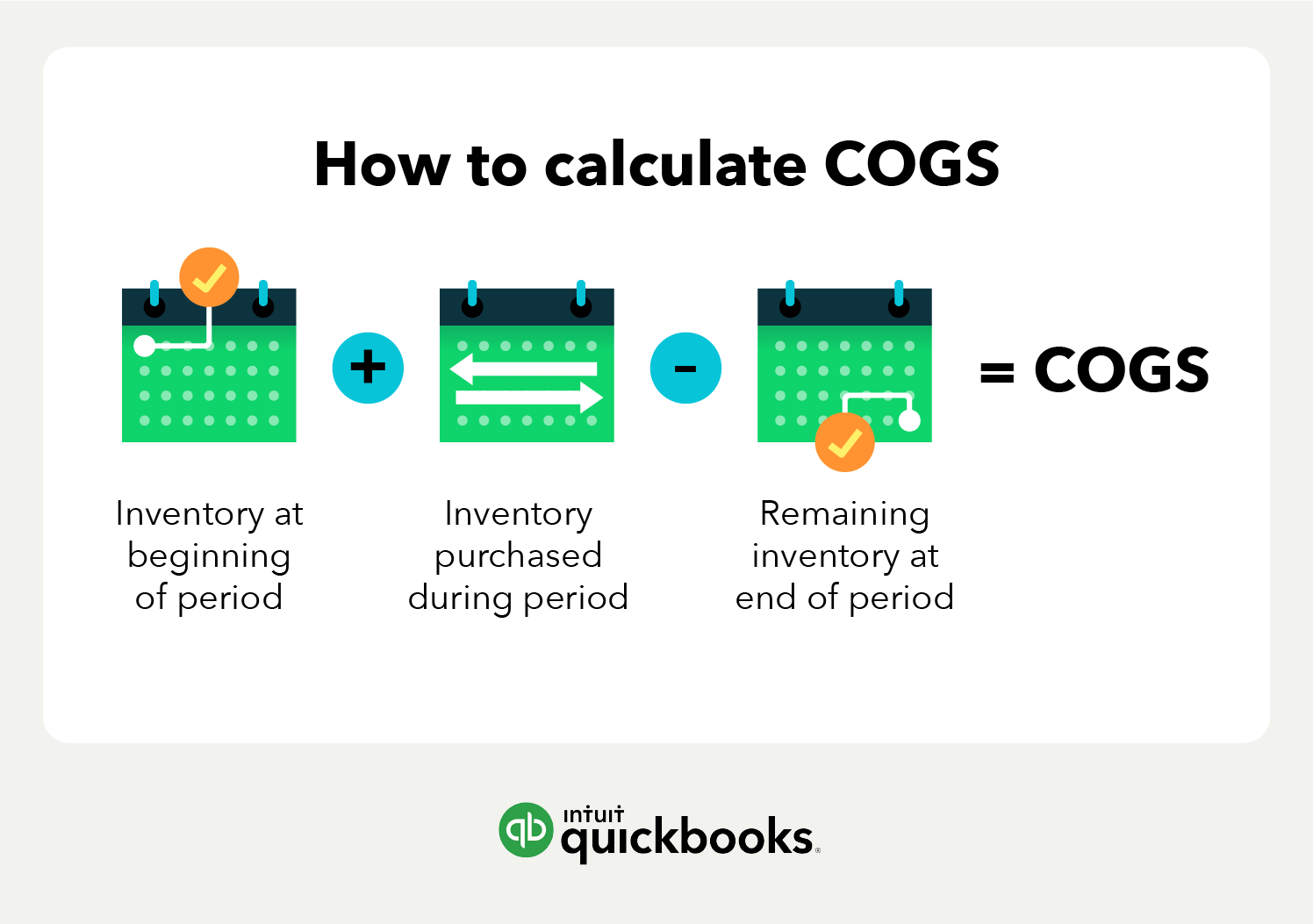

Calculating COGS can be a bit tricky depending on your inventory valuation method (FIFO, LIFO, or weighted average don't worry, we won't go there!). But the basic idea is to figure out the cost of the goods you sold during a specific period, not just the goods you made. If you bake 10 cakes but only sell 8, your COGS is based on the cost of those 8 cakes, not all 10.

Ultimately, understanding your COGS is important because it feeds directly into your gross profit calculation (Revenue - COGS = Gross Profit). A higher COGS means lower profits, which, in turn, means less money to reinvest in your business or, you know, take home as a paycheck. Keeping a close eye on COGS and finding ways to optimize it can significantly improve your bottom line.

Bill of Materials

3. The Essential Parts List for Success

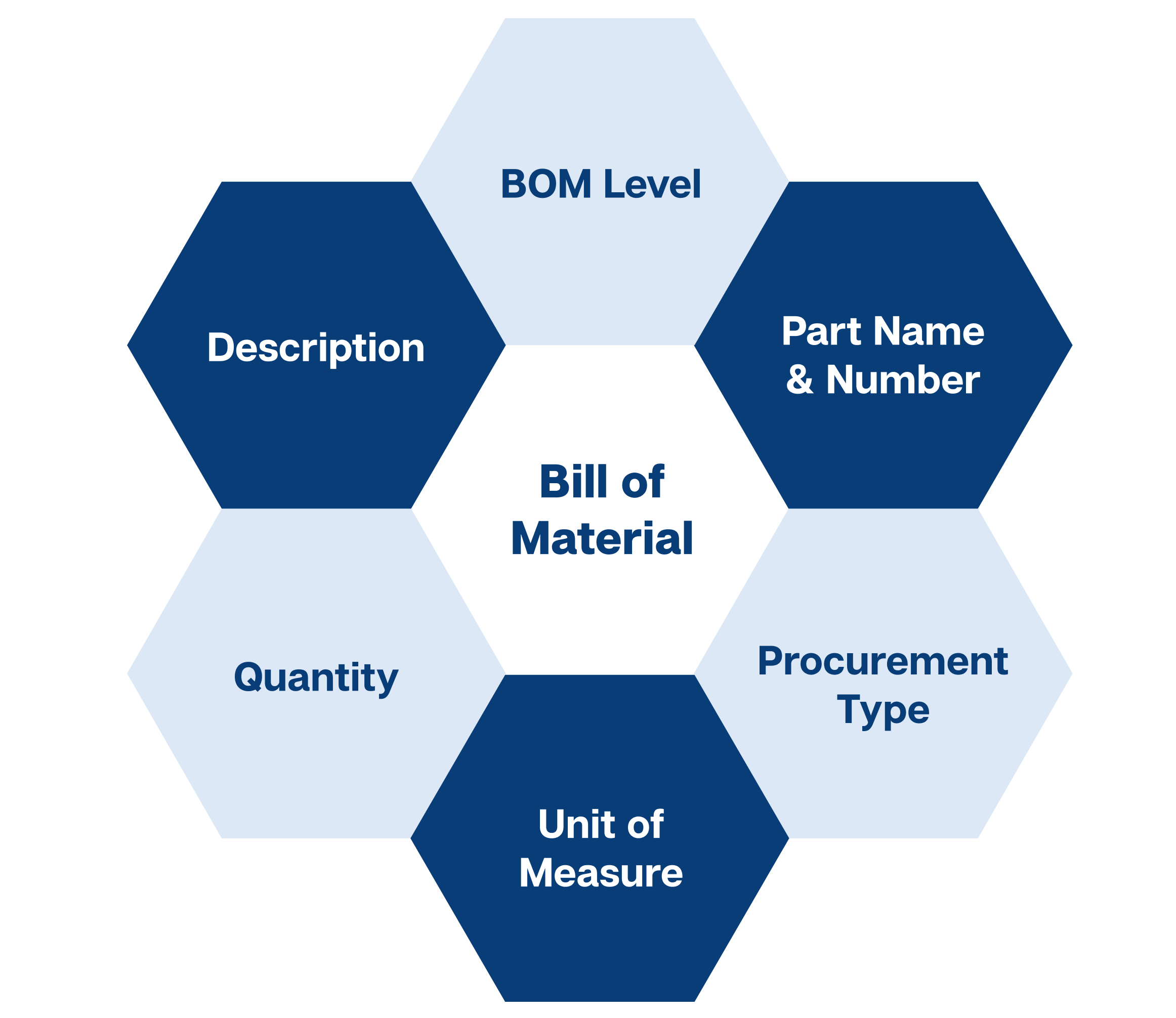

Now, let's talk about the Bill of Materials (BOM). This document is your product's recipe; detailing every single component, assembly, and raw material needed to create it. Think of it as the blueprint that guides your manufacturing process. A well-structured BOM is vital for efficient production, accurate inventory management, and ultimately, cost control. Mess up the BOM and you might end up with a batch of missing items or the wrong ingredients.

A BOM isn't just a list of ingredients; it also specifies the quantity of each item needed. For example, if your product needs four screws, the BOM will clearly state that. This level of detail helps prevent shortages, ensures consistent product quality, and allows you to accurately calculate the cost of materials for each product. It can also help identify opportunities for cost savings by switching to less expensive materials or optimizing the production process.

There are different types of BOMs, depending on the complexity of your product and manufacturing process. A single-level BOM lists all the components directly used in the product. A multi-level BOM breaks down each assembly into its sub-assemblies and components, providing a hierarchical view of the product structure. Choosing the right type of BOM depends on the scale and complexity of your operations.

Think about the cake again! The BOM wouldn't just say "flour," it would say "2 cups all-purpose flour." It would also list the specific type of frosting, the number of sprinkles, and even the size of the cake pan. The more detailed your BOM, the smoother your production process will be.

Bill Of Materials (BOM) Meaning, Types, Purpose, And Examples

How They Work Together

4. The Intertwined Relationship of COGS and BOM

So, how do these two concepts work together? Well, the Bill of Materials essentially feeds into the COGS calculation. The BOM provides the detailed list of materials needed, which then gets priced out to determine the raw materials component of your COGS. Imagine trying to calculate the cost of your cake without knowing exactly what ingredients you needed and how much they cost. That's where the BOM comes in!

Let's say you change a component in your product — maybe you switch to a cheaper type of screw. This change would be reflected in the Bill of Materials, which would then directly impact the raw materials cost component of your COGS. This shows how a seemingly small change in the BOM can have a ripple effect on your overall profitability. Therefore, accurate and up-to-date BOMs are essential for accurate COGS calculations.

Furthermore, analyzing the Bill of Materials can reveal areas where you can optimize your COGS. Maybe you can negotiate better prices with your suppliers, find alternative materials, or streamline your production process to reduce waste. The BOM provides the data you need to make informed decisions about cost reduction.

In essence, the BOM is the foundation upon which your COGS is built. It provides the detailed information about the materials needed, while the COGS provides the financial summary of those materials (and other direct costs). They're two sides of the same coin, working together to give you a complete picture of your product's cost and profitability.

Avoiding Common Pitfalls

5. Keeping Your COGS and BOM Accurate

One common mistake is neglecting to update the Bill of Materials when changes are made to the product design or materials used. This can lead to inaccurate COGS calculations, incorrect inventory levels, and ultimately, production delays. Always make sure your BOM reflects the current state of your product.

Another pitfall is failing to accurately track direct labor and manufacturing overhead costs. These costs can be significant, especially for products that require extensive manual labor or specialized equipment. Don't underestimate the importance of tracking these costs accurately to get a true picture of your COGS.

Also, not regularly reviewing your BOM for potential cost-saving opportunities is a big mistake. Are there alternative materials that can be used without compromising product quality? Can you negotiate better prices with your suppliers? Continuously looking for ways to optimize your BOM can have a significant impact on your COGS and your overall profitability.

Finally, overlooking the integration between your BOM and your accounting system can lead to inefficiencies and errors. Ensure your systems are properly integrated so that changes in the BOM are automatically reflected in your COGS calculations. The key takeaway is simple: keep your data accurate, up-to-date and synchronized.

FAQ

6. Let's Clear Up Any Confusion

Q: Is COGS the same as operating expenses?A: No, COGS only includes direct costs of producing goods. Operating expenses are the costs of running the business (marketing, admin, sales, etc.)

Q: How often should I update my Bill of Materials?A: Whenever there's a change to your product design, materials, or manufacturing process.

Q: What happens if my BOM is inaccurate?A: Inaccurate BOMs can lead to incorrect COGS calculations, production delays, and inventory mismanagement, impacting the bottom line.